Fundamentally Fraud

We have a president manifesting ALL the traits of a psychopathic narcissist, lying about seemingly everything.

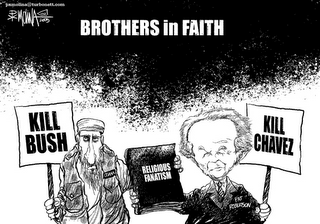

We have a president manifesting ALL the traits of a psychopathic narcissist, lying about seemingly everything. Brothers in faith indeed, heck the Christian Coalition takes faith based funding and sends it to Charles Taylor - who is linked to Al Qaeda. Of course Taylor is now on trial for war crimes.

Brothers in faith indeed, heck the Christian Coalition takes faith based funding and sends it to Charles Taylor - who is linked to Al Qaeda. Of course Taylor is now on trial for war crimes.Isn't that funding terrorism? Funny how the laws never apply to them. You would think the mafia was in charge of the country.

The "Dubya And Dick" Scandal Chart

http://www.bidstrup.com/decency.htm

The Bush Administration Working To "restore decency and integrity to the Oval Office"And Confidence To The Markets

Yes, Dick Cheney actually said that!

It was all just a giant pyramid scheme. And like any pyramid scheme, it created a bubble and that bubble had to eventually burst. The apologists for free-market fundamentalism claim that the business scandals we've seen so far are an anomaly. Alas, it would be wonderful if it were true. But it's not. As Graham Turner, a BBC business journalist has shown, it's clearly symptomatic of a basic, systemic problem that is going unaddressed, even by the supposed "reforms" recently passed by Congress and signed by the president. As a result, I have created this chart to give you an idea of the true extent of the symptoms created by this problem. (click on link - chart is quite large)

Note that this chart only shows the tip of the iceberg. It does not show the detail - the day to day incidents of a small scale that don't make the headlines. Nor does it show all of the other less-well-known scandals, incompetence, conflicts of interest and ideological outrages, far too numerous to mention here, that beset the Bush administration.

If the chart is unreadable on your browser, click here. If you have a full-blown large format printer or plotter available to you, click here for the uncompressed full-size version. It prints out nicely on an 11x17 printer or plotter. It's a big file, though, so be warned. If you right-click on either link, you can download the file and save to disk. Click on "save target as" or "save link as" from the popup menu.

And The Parable of The Two Cows And How "Neo-liberal" Free-Market Fundamentalism Generates Wealth...In case you're confused about how "neo-liberal capitalism" generates wealth, here's an explanation, in "parable" form you can understand:

In traditional, "regulated capitalism," you have two cows. You sell one and buy a bull. Your herd multiplies and your net worth and the economy grows. You sell part of the herd or the milk, and you live on the profits.

In deregulated "neo-liberal" free-market, de-regulated capitalism, you start out with two cows. You do an Initial Public Offering of stock in your new cow company, showing as your principle asset, your intent to use the proceeds from the IPO to purchase the two cows from yourself. The public goes along with your business plan, because their investment will be secured by the equity in the two cows, so the public buys stock from you.

You sell all three cows to your publicly listed company, using letters of credit opened by your brother-in-law at the bank. He doesn't worry about opening dodgy letters of credit secured only by stock in an IPO, because you've promised him some stock and a job at a hugely inflated salary if he gets fired. This transaction makes you very wealthy.

You then execute an asset/equity swap, using your executive stock options as a security, so that you get all four cows back, and of course, you take a tax exemption for all five cows, based on the fact that they're a business investment. Your publicly listed company shows the swap as an "un-depreciated capital expense" and current income concurrently, thus showing a profit on the transaction for the current quarter. So your publicly traded company can show the cows as an asset, you arrange to lease the cows back to the publicly traded company. The company shows the lease on its books as a capital asset, making the company's net worth look even better. This transaction makes you very, very wealthy. You show the lease income on your personal tax return as business income in a special purpose entity incorporated in the Bahamas, not as personal income, thereby avoiding U.S. taxes on it.

The milk rights of the six cows are sold through an acquaintance of yours, who happens to have a job in the administration in Washington. You know him because he used to work for you. He uses his influence to help clear the regulatory barriers to selling the milk rights to a Cayman Islands company, set up specifically for the purpose (and set up in the Caymans to avoid the scrutiny of the Bahamian regulators), which happens to be secretly owned by you. You show the proceeds from the milk rights sales on the balance sheet of your publicly listed company as current income, thus adding to the current quarter's profits.

The Cayman Islands company sells the milk rights to all seven cows back to your listed company at a vastly inflated profit, throwing in an option on a bull which it does not actually own, but on which it holds a lease at an above-market price from a rancher in Crawford, Texas. The rancher is a friend of yours. He happens to be very well connected. The above-market price was arranged as a contribution to the rancher's political campaign fund.

On the balance sheet of your publicly traded company, you show the re-purchase costs of the milk rights as an "undepreciated capital expense," thus allowing you to defer showing the expense to your listed company on the balance sheet to future years, and not seriously affect the current quarter's profits. The repurchased milk rights themselves are shown as a newly acquired capital asset, thus improving your company's apparent net worth.

The CEO of the Cayman Islands company, which just happens to be you, takes the profit from the milk rights sales as an "executive bonus" and deposits it in a "private" bank in the Seychelles (to avoid possible impoundment by the regulators in the Caymans). Your auditor at the publicly traded company goes along with this "flip," because you're paying him a large retainer for some "consulting" work (namely setting up the Cayman Islands company as well as the Seychelles "bank") - as well as actually keeping the books he's supposedly "independently" auditing for you at the same time. You become very, very, very wealthy, and your publicly traded company's balance sheet just keeps looking better and better, with nary a hint of complaint by the auditors. Your company's growth is the subject of a favorable mention on Wall Street Week.

Thus your listed company's annual report and the Form 10-Q you file with the Securities and Exchange Commission implies without stating overtly that the company owns eight cows, with full milk rights, with an option on a bull. Just after the 10-Q is filed and when no one is looking, you sell one cow to make hefty donations to the campaign fund (through "soft" money, of course) of a newly appointed president of the United States, leaving your publicly listed company with nine cows. Of course, that new president is that rancher from Crawford, Texas, and he owns the bull on which your company holds a lease-option. A pesky Securities and Exchange Commission investigator notices a problem with the books, and questions the listing of a lease-option as being a capital asset, so you contact your rancher friend from Crawford, and suddenly, there's no problem.

In the creatively-written annual report and the 10-Q filings, the company looks healthy. So the stock price has been rising, and as long as it does, the stockholders don't pay much attention to what you're doing as their CEO. Like sheep, they go along when you have your hand-picked Board of Directors issue some additional stock, which of course dilutes the value of the stock that's already held by current stockholders or your employees, whose compensation consists mostly of stock options. The new stock, of course, goes to the board and to you as an executive bonus, which you then sell as soon as you can do so discreetly, because you know how the company really works, and you know what's coming. You become very, very, very, very wealthy. You hide yet more of your money in your "private" Seychelles "bank."

The Securities and Exchange Commission, whose chairman is a senior partner in the law firm of which your lawyer is a junior partner, accepts your 10-Q and annual report as submitted. The securities analysts on Wall Street go along too, because they make a commission on the sale of your stock, so of course they're going to issue a "buy" rating on the stock, so they'll sell more of it, making themselves and their firm richer -- even though privately, they're telling each other it's really just wallpaper.

The public buys your bull. But eventually, a business news reporter notices that there's only two cows, not nine cows and a bull, and they're really owned by you, and an article about it appears in the Wall Street Journal. So the stock price of your publicly traded company collapses. You're "fired," the books are audited and the balance sheet is restated, and your company files for a chapter 11, but since there are no real assets, the judge liquidates the company, with creditors getting three cents on the dollar. The stockholders and employees are, of course, left holding the bag. But that's OK, because you sold your stock before the collapse.

There's an SEC investigation. The auditor goes to jail. You're prosecuted for fraud, but because of your influence, you do 30 days at Club Fed, and the rest of your sentence is suspended. The rancher from Crawford gets re-elected, because he's helping others generate lots of new wealth just like you did. The stockholders and employees sue, but they can't get anything because all your money is in your offshore Seychelles "bank" and can't be touched.

You buy a $10 million beachfront mansion in Key Biscayne, which you immediately homestead so it can't be siezed, and divide your time among sailing in Biscayne Bay, gambling at Monte Carlo and starting up a new IPO, with help from your rancher friend from Crawford and all his friends.

Now, isn't the wealth-creating power of de-regulated "neo-liberal capitalism" truly awesome?

Copyright © 2002, 2003 Scott Bidstrup. All rights reserved.

There are over 240 MILLION Americans, surely there are a few million who can march on the White House holding candles, and demanding the resignations of Bush, Cheney, Rove, Rice, ... well the lot. It is an illegal, immoral, and currently criminal administration, and under the Declaration of Independence it is time to call them to account.

We can expect George to be total idiot when confronted, he has never had to face anything on his own in his life. Don't ya think its time?

0 Comments:

Post a Comment

<< Home